Bosch believes AIoT, electrification and green hydrogen are the way forward

Balance sheet 2020: financial year better than expected

- Denner, CEO of Bosch: “Bosch has weathered the first coronagraph well.”

- In the field of powertrains, electromobility will be the future core business.

- Asenkerschbaumer, Bosch CFO: “With a good first quarter, Bosch 2021 has started successfully.”

- AIoT: sales target of 8 million devices with home connectivity.

- Fuel cells: Bosch plans to invest more than a billion euros in this technology from 2021 to 2024.

- Financial year 2020: turnover 71.5 billion euros, result 2.0 billion euros

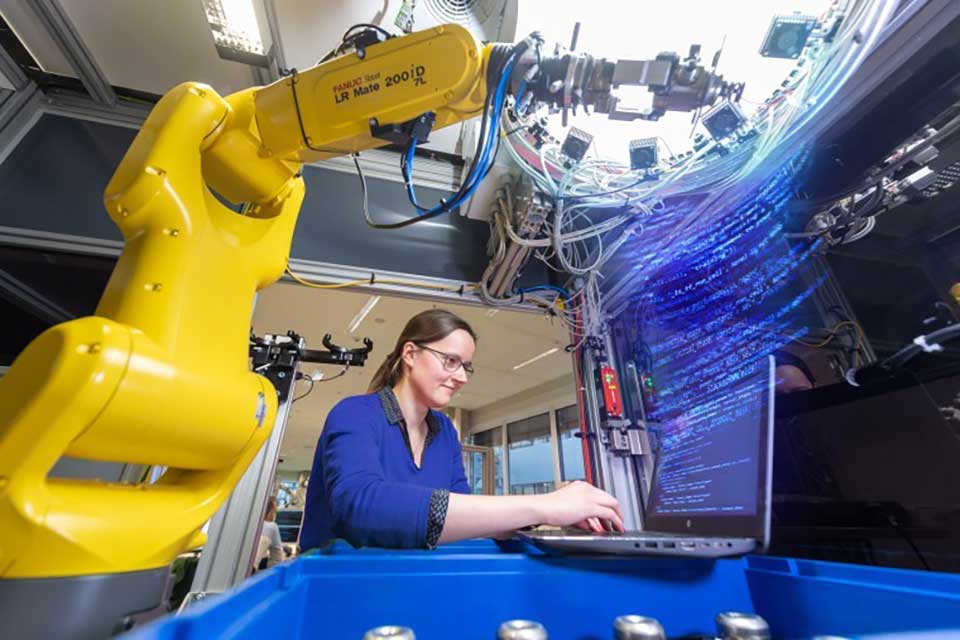

Renningen and Stuttgart - The technology and services company Bosch combines the Internet of Things (IoT) with artificial intelligence (AI) and believes that electromobility will offer new opportunities, thanks in part to the profound technological and ecological changes currently taking place. “Bosch has weathered the first coronagraph well,” said Dr Volkmar Denner, chairman of the management board of Robert Bosch GmbH, on the occasion of the press conference on the 2020 annual report. “We are one of the winners in the transition to electromobility and we are significantly expanding our software business by linking artificial intelligence to it.”

In powertrain technology, electromobility is developing into Bosch's core business. According to Denner, the company is making large pre-investments for this, another 700 million euros this year alone. Bosch has already spent a total of five billion euros on pre-investment in electromobility. Currently, Bosch's sales in electric powertrain components are growing by almost 40 per cent, twice as fast as the market. The goal is to increase annual sales fivefold to around five billion euros by 2025, with the break-even point to be reached a year earlier. “Electromobility has long since ceased to be a pipe dream. Our pre-investments are starting to pay off,” the Bosch CEO said at the online press conference. In total, Bosch has already acquired an order volume of more than 20 billion euros until the end of 2020.

Bosch Group sales in the first three months of this year increased by 17.0 per cent compared to the previous year. “With a good first quarter, Bosch has started 2021 successfully,” said Prof Stefan Asenkerschbaumer, CFO and deputy chairman of Bosch's executive board. He expressed confidence for 2021, but expects it to be another challenging year. For the current reporting period, revenue is expected to increase by about 6 per cent compared to last year, while the operating margin will improve slightly to about 3 per cent - or about 4 per cent without restructuring costs. “The year 2021 will be an important milestone on the way to achieving our target margin of around 7 per cent again in the next two to three years,” Asenkerschbaumer said. The encouraging fiscal year 2020 - despite the pandemic - with an operating result (operating EBIT, adjusted for effects of purchase price allocations for Automotive Steering and BSH-Hausgeräte) of 2.0 billion euros is crucial for Bosch, as it provides the company with a solid basis to continue investing in areas of future importance. With sales of 71.5 billion euros, research and development spending remained almost stable at 5.9 billion euros and the operating EBIT margin was 2.8 per cent. Adjusted for restructuring costs, which are an additional burden on earnings in 2020, it was 4.7 per cent.

Megatrend connectivity: customers become an integral part of development

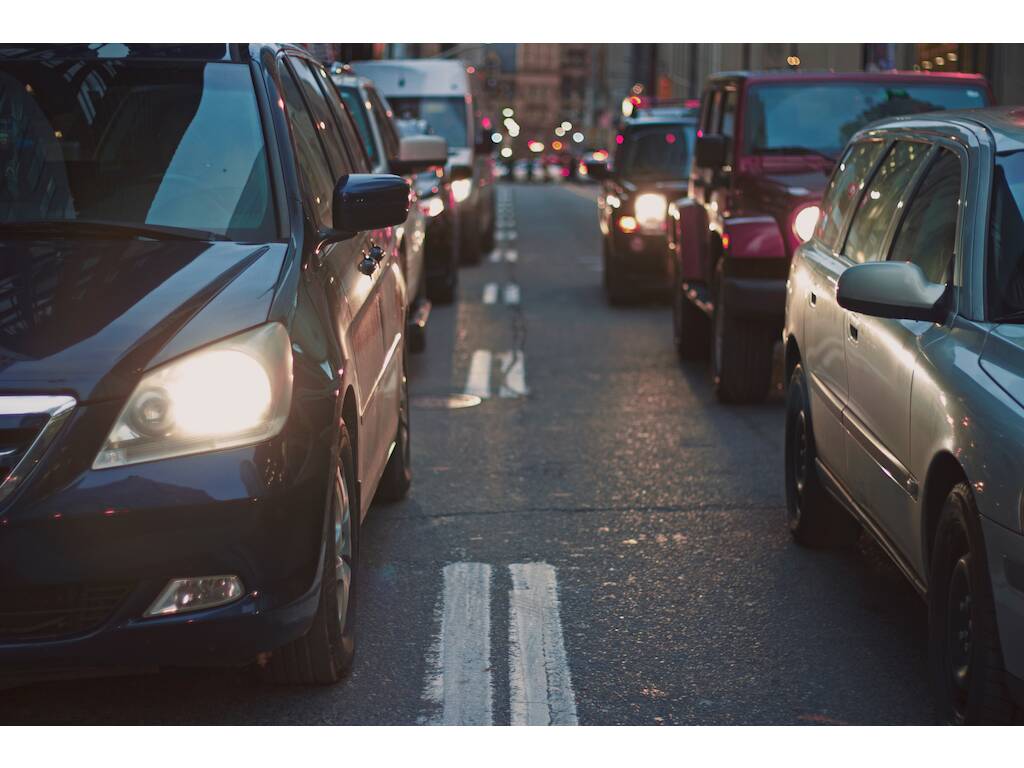

Bosch aims to leverage its competitive advantage derived from its versatile experience in combining connectivity (Internet of Things IoT) and artificial intelligence (AI) to generate future business and become a leading AIoT company. In the coming years, Bosch expects AI-based products to generate billions in sales. Sales of connected home devices are expected to double from four million last year to around eight million units by 2021. Moreover, Bosch also plans to apply AI to evaluate data on the usage of its products to create new features and services for customers through software updates. “Connected things leads to knowledge about how things are used,” Denner explains. “This allows us to continuously improve our products, keep them up-to-date and offer our customers more benefits.” In the field of video security, for example, video analysis based on neural networks opens up new possibilities. To this end, Bosch is integrating detectors into both new cameras and an AI box that can be connected to installed devices. The first application is a ‘traffic detector’ that can initially accurately detect and locate vehicles in heavy traffic situations, even in difficult lighting conditions. The more data flows into the customer application, the more AI can do, including accurate accident detection, the company said.

Electrification megatrend: new opportunities in various sectors

Global efforts to combat climate change are encouraging electrification and green hydrogen. Denner believes electrification offers new opportunities in different business areas: “Electrification requires solutions not only for electric driving in cars, but also for electric heating in buildings.” In electromobility, the main drivers for change are falling battery costs and emission standards to meet climate protection targets. In Building Technology, especially in heating and air-conditioning, the use of heat pumps and renewable energy sources is playing an increasing role.

In Thermotechnology, for example, Bosch is growing significantly faster than the market with electric solutions. Sales of heat pumps increased by more than 20 per cent by 2020 and are expected to triple by 2025, according to Denner. The company also expects a strong growth spurt in residential building renovation required under the European Green Deal. To achieve this, Bosch plans to leverage its ‘investment power, large-scale production capacity and commercialisation expertise’. Sales of highly efficient and quiet air-water heat pumps alone will almost double at Bosch in Germany by 2020.

Hydrogen megatrend: billion-dollar fuel cell market

Bosch is also counting on a growth market for the hydrogen megatrend: the company estimates the market volume for green hydrogen, in the EU by 2030, at almost 40 billion euros, with annual growth rates of 65 per cent. The company is developing stationary and mobile fuel cell solutions that convert hydrogen into electricity. Bosch plans to invest more than a billion euros in fuel cell technology between 2021 and 2024. “Bosch is already H2-ready,” says Denner. Just this year, the company plans to commission 100 stationary fuel cell power plants to supply electricity to data centres, industrial producers and residential areas. A stationary solid oxide-based fuel cell has been operational in Bamberg city centre since the end of March 2021. This was the first realisation by Bosch, in cooperation with the Bamberg municipal utility.

Bosch estimates that the market for mobile fuel cell components will be worth around 18 billion euros by the end of the decade. Denner believes Bosch is well positioned for this: “We have everything we need to be a leader in this market as well.” Just recently, Bosch entered into a fuel cell drive joint venture with China's Qingling Motor Group. A test fleet of 70 trucks will be put into service before the end of this year.

Denner: EU plans could jeopardise carbon neutrality

The Bosch CEO does not consider the EU's initial plans for the Euro 7 emissions standard to be appropriate, but he expressed satisfaction that the debate is moving and becoming more objective. He explained his position as follows: “Climate action is not about the end of the internal combustion engine, but about the end of fossil fuels. CO2-neutral road traffic can be achieved with e-mobility and green charging power, but also with renewable fuels.” The Bosch CEO reminded his audience that climate-neutral mobility is almost as ambitious a goal as flying to the moon in the 1960s. But instead of just setting the grand goal of ‘first man on the moon’ and leaving the concrete elaboration to the engineers, like US President Kennedy did at the time, the European Commission is doing exactly the opposite. “In this way, alternative paths to climate protection are cut off,” Denner said. “If society really wants climate action, it is essential that we do not pit technological approaches against each other. Instead, we should combine them.”

CO2 reduction at Bosch: along the entire value chain

Bosch is pressing ahead with its own climate goals as planned. Now that the climate neutral status of the Bosch Group, with more than 400 locations worldwide, has been certified, Bosch is taking more concrete steps to achieve scope 3. Throughout the entire value chain, from suppliers to customers, carbon emissions are to be reduced by 15 per cent by 2030 compared to 2018 levels, representing 67 million tonnes less carbon dioxide emissions. “Our efforts will drive our product portfolio towards energy efficiency or even technological change. In the future, the carbon footprint of a supplier or logistics provider will also be a criterion for awarding new procurement contracts,” Denner says. “This will contribute to climate protection.”.

Outlook 2021: despite confidence, it remains a challenging year

Bosch expects the global economy to grow by just under 4 per cent this year, following a 3.8 per cent decline last year. “Although we started the 2021 financial year with confidence, the pandemic continues to pose significant risks,” Asenkerschbaumer explained. The CFO added that Bosch is aware of the market bottlenecks in the automotive sector, especially in the semiconductors segment, where demand is very high. The company is doing all it can to support its customers in this tense situation. But an improvement in the short term is not to be expected and the situation may also affect business developments in the current year. In the long term, Asenkerschbaumer needs to make all automotive supply chains less susceptible to failure. Moreover, aligning the mobility division with future areas such as electromobility, automated driving or future electronics architecture requires huge pre-investments, he added. “In this profound transformation, 2021 will be a very important and challenging year for us.”

Fiscal year 2020: coronavirus pandemic under control

The Bosch Group's turnover in 2020 was 71.5 billion euros. Due to the pandemic, it was 6.4 per cent below last year's level, or 4.3 per cent after adjusting for currency effects. The company generated an operating profit (operating EBIT, adjusted for effects of purchase price acquisitions for Automotive Steering and BSH-Hausgeräte) of 2.0 billion euros. The operating EBIT margin was 2.8 per cent. “Better sales in the second half of the year and significant cost savings helped to cushion the impact of the pandemic,” Asenkerschbaumer explained. The solvency ratio remains at a high level of 44 per cent, while free cash flow reached a record level of 5.1 billion euros. Seeing the company in a satisfactory liquidity situation, the CFO stressed, “Bosch still has a healthy financial structure that allows it to focus on areas that will continue to be important in the future. “

Financial year 2020: development by business sector

The Bosch Group's broad positioning was again justified in 2020 by balancing various business developments. In the Mobility Solutions business sector, sales developed better than the market. At 42.1 billion euros, sales were 10 per cent lower than the previous year. Global car production fell 16 per cent in the same period. After adjusting for currency effects, the decline was 8.2 per cent. The operating EBIT margin was minus 1.3 per cent and was also affected by a reshuffling of operations. In the Industrial Technology sector, sales reached EUR 5.1 billion. As the market was already declining before the corona pandemic, sales fell 17 per cent1, or 15 per cent after adjusting for currency effects. EBIT margin was lower than last year at 4.7 per cent. In the Consumer Goods business sector, demand for household appliances and power tools increased significantly during the pandemic. Sales rose 5.1 per cent to 18.7 billion euros. After adjusting for currency effects, the increase was 8.4 per cent. Operating profit peaked at 11.5 per cent. In the Energy and Building Technology business sector, sales fell 2.7 per cent, or 0.8 per cent after adjusting for currency effects. With sales of EUR 5.5 billion, the EBIT margin was 4.6 per cent.

Financial year 2020: development by region

In Europe, full-year sales of 38.0 billion euros were 5.1 per cent below last year, or 3.7 per cent after adjusting for currency effects. In North America, sales were 10.7 billion euros, down 15.5 per cent. After adjusting for currency effects, this corresponds to 12.8 per cent. In South America, currency effects had a particularly large impact on sales. Sales of 1.1 billion euros were 22.3 per cent below last year's, but after adjusting for currency effects, sales fell by only 0.2 per cent. In Asia-Pacific, including other regions, the early and strong market recovery in China cushioned the impact of the corona pandemic. Sales of 21.7 billion euros fell only slightly by 2.6 per cent, or by barely 0.7 per cent after adjusting for currency effects.

Employees: change also creates opportunities

According to Denner, the transformation at Bosch will cost jobs on the one hand, but also open up new perspectives for associates. For example, Bosch is using skills from the development and production of petrol and diesel systems for new technologies such as fuel cells in its main plants. “More than half of the electromobility jobs we have already filled with employees from the internal combustion engine sector,” said the Bosch CEO. In addition, a business placement platform has been created to fill positions in future fields with specialists at short notice. Bosch is also making progress in digital training: since the beginning of 2020, the company has registered more than 400,000 hits on its internal learning platform. In 2020, more than one in three training courses took place online, and this figure will rise to one in two by 2023.

As of 31 December 2020, the Bosch Group employed around 395,000 associates worldwide. That is about 3,100 associates or about one per cent less than last year. The number of associates fell mainly in Asia-Pacific. In Germany, the number of associates remained largely stable at 131,800. At the same time, the number of researchers and developers worldwide increased by about 600 to around 73,200. The number of software developers also grew by over 10 per cent to around 34,000.