Bosch commits to innovations, partnerships and acquisitions - cost reduction remains a focus

Growth targets require high profitability and financial strength

- Progress in FY2023: sales increased to 91.6 billion euros / EBIT margin from operations to 5.3 per cent year-on-year

- Outlook for 2024 remains subdued: expected sales growth of 5 to 7 per cent / EBIT margin at most at last year's level

- Despite continuing difficult economic conditions, Bosch recorded growth of 11% in Belgium compared to the previous year

- Expansion focuses on growth areas: example of medical technology - 300 million euros investment with two new partners

- Stefan Hartung: “We are committed to innovations, partnerships and acquisitions. Despite the economic headwinds, this will enable us to continue to grow and maximise our opportunities as our industries transform.”

- Markus Forschner: “Our targets for 2024 are very ambitious. We do not expect any economic windfalls and need to reduce costs further to remain competitive.”

The Bosch Group increased its sales and profits in 2023 and is successfully implementing its growth strategy despite a difficult environment. At the presentation of the company's annual figures, it said Stefan Hartung, chairman of the executive board of Robert Bosch GmbH: “We achieved our financial targets in fiscal year 2023 and strengthened our market position in a number of business areas, from semiconductors to integrated building systems. We are committed to innovations, partnerships and acquisitions to ensure our continued growth as our industries transform - and that despite the economic headwinds.” The technology and services provider aims to achieve long-term average annual growth of 6 to 8 per cent with a margin of at least 7 per cent. Bosch also wants to be among the top three suppliers in its key markets in all regions of the world.

Bosch is also strategically expanding areas of innovation with growth potential. For example, the company has announced that it is working on a new BioMEMS technology works that combines molecular diagnostics with microsystems technology. That technology enables accurate testing for up to 250 genetic traits, such as pathogens or genetic mutations, on a single chip and that directly at the point of care, e.g. the doctor's office. “BioMEMS combines modular diagnostics with the microsystem technology that Bosch is already using in smartphones and ESP antislip systems,” says Hartung. One of the first bioMEMS tests the company is developing targets various pathogens that cause sepsis or blood poisoning. Bosch recently entered into a development and sales partnership with Randox for this purpose. An additional strategic collaboration with r-Biopharm should accelerate the development of a fully automated test for multi-resistant bacteria. Together with these two partners, Bosch will invest around 300 million euros by 2030.

Improving revenue and earnings in 2023 - 2024 remains challenging

In the past fiscal year, Bosch achieved sales of 91.6 billion euros despite unfavourable economic and market conditions. This represents an increase of 3.8 per cent, or 8.0 per cent adjusted for exchange rate effects. Operating profit before interest and taxes (EBIT) was 4.8 billion euros (2022: 3.8 billion euros). At 5.3 per cent, the EBIT margin from operating activities was 1 percentage point higher than last year. That was better than expected, but still lower than the long-term target margin of at least 7 per cent. Bosch wants to achieve that margin by 2026. “We need high profitability and great financial strength to be able to self-finance our growth targets as much as possible,” said Markus Forschner, member of the executive board and chief financial officer of Robert Bosch GmbH. “A successful final sprint in 2023 helped us meet our expectations. But the 2024 financial year will be at least as challenging as 2023.”

Bosch's overall outlook for the current year remains subdued, especially in light of the current economic context. “We do not expect any economic windfalls in 2024,” explains Forschner. He expects global economic growth of only 2.3 per cent in 2024, along with stagnating vehicle production and a persistently weak mechanical engineering market. On the other hand, the consumer products market could improve slightly after two years of consumer restraint. Bosch expects its own business to stabilise, thanks to both innovations and the expansion of its international footprint. For instance, a new furnace plant in Egypt and a refrigerator plant in Mexico are currently under construction.

In the first quarter of 2024, sales were down 0.8 per cent year-on-year; adjusted for exchange rate effects, this corresponds to an increase of 2.7 per cent. “This clearly shows that the 5 to 7 per cent revenue growth we are aiming for with our full-year planning is very ambitious,” adds Forschner. According to the CFO, it will be difficult to improve the EBIT margin from operating activities compared to last year: “We are not only facing a subdued market environment and an expected further increase in initial investments in strategically important areas. Restructuring and process improvements will also have a negative impact initially. It will therefore take some time before their positive impact is felt.” Moreover, Bosch intends to further reduce costs and adapt its structures to remain competitive as its industries transform. As Forschner said, “We will implement the necessary measures consistently, but with a sense of proportion.” Any personnel adjustments will be made without compulsory redundancies and in consultation with social partners.

Development of business activity in Belgium: growth in 2023

Bosch in Belgium closed the 2023 financial year with consolidated sales of almost 914 million euros, a growth of 11% compared to the previous year. “Despite continuing difficult economic conditions, we managed to achieve positive growth in Belgium in fiscal year 2023,” said Patrick Incoletti, Bosch Benelux managing director. Bosch's sales in Belgium increased mainly due to the performance of the Mobility business sector. As of 31 December 2023, the Bosch Group in Belgium had about 1160 associates. Bosch in Belgium's forecast for the current financial year is subdued, in light of ongoing global economic and geopolitical challenges. “Although we expect a challenging year in Belgium, we continue to strengthen our position and long-term potential in the local market,” Incoletti explained.

Bosch in Belgium is maintaining its ambition to make its office buildings and factories more sustainable. “Our site in Anderlecht now also has solar panels to generate its own energy,” Incoletti continued. To contribute even more to Bosch's climate operation, Bosch in Belgium proposed the BrefurbiSH initiative. This collaboration between Sirris, Circular.brussels, Lichtwerk and BSH Home Appliances aims to make the refurbishing process of household appliances more efficient using advanced data analysis and cognitive and functional operator support. In this way, Bosch aims to eliminate 50 tonnes of appliances from the waste stream every year.

Bosch in Belgium also continues to work on road safety. At the end of 2023, Flanders became the first region in the world with a real-time detection system that personally alerts both the phantom driver himself and drivers near a phantom driver via in-car navigation apps. The system was developed by Bosch and fits into the Mobilidata programme From the Flemish government and imec.

Growth domain: sustainable mobility

In its core mobility business, Bosch continues to work on strategic decisions for future growth. This year alone, the company is launching around 30 production projects for electric vehicles. “Electromobility is coming. The only question is how fast it will catch on in different parts of the world,” says Hartung. “We estimate that 70 per cent of all new cars in Europe will be pure electric by 2030. The figure in China and North America may be 40 to 50 per cent.” Where heavy vehicles are needed to cover long distances, the Bosch chairman says solutions such as plug-in hybrid drives and range extenders will remain in demand for some time to come. The Mobility business sector expects an additional boost from vehicle dynamics. With new and redundant braking systems tailored to electric and automated driving, Bosch is growing by 10 per cent annually - significantly faster than the market. And with Vehicle Motion Management (VMM), Bosch is working on an innovative system solution that coordinates all aspects of vehicle motion, controlling the brakes, steering, driveline and dampers. In recent winter tests alone, Bosch has equipped more than 20 vehicles from major brands with variants of VMM. “We are early adopters and will put our first order into series production this year,” says Hartung. The company expects to achieve sales of hundreds of millions by 2030.

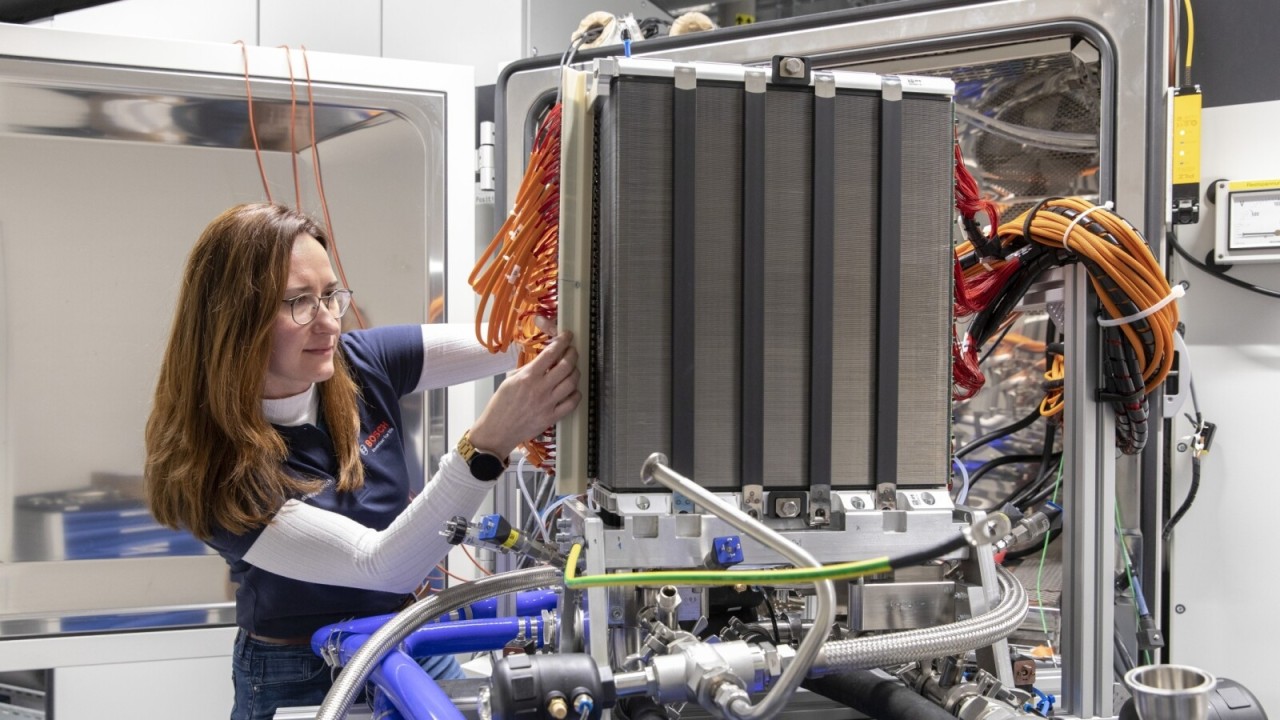

Growth domain: hydrogen

Bosch confirms its expectations for the growth area of hydrogen: its sales in hydrogen technology could reach 5 billion euros by 2030. “In 2023, we started producing fuel cell systems in Stuttgart, Germany, and Chongqin, China,” says Hartung. China will probably be the main market for the time being. Bosch does not expect strong growth in Europe or North America until the next decade. From a technical point of view, hydrogen engines are the fastest route to climate-neutral truck transport. Bosch expects the market for this technology to be worth almost 1 billion euros by 2030. Bosch's CEO explains: “This year, hydrogen engines with our injection technology will already be on the road in India. We are already working on five orders from well-known truck manufacturers from the world's three major economic regions.” Bosch also wants to participate in the fast-growing hydrogen production market: by 2030, global installed hydrogen electrolysis production capacity will exceed 170 gigawatts. That's about 25 times more than today. “Our electrolysis module is on track for market launch next year,” says Hartung. “In the future, Bosch will not only be synonymous with hydrogen drives but also with hydrogen production. As a supplier, we will actively help shape the future market.”

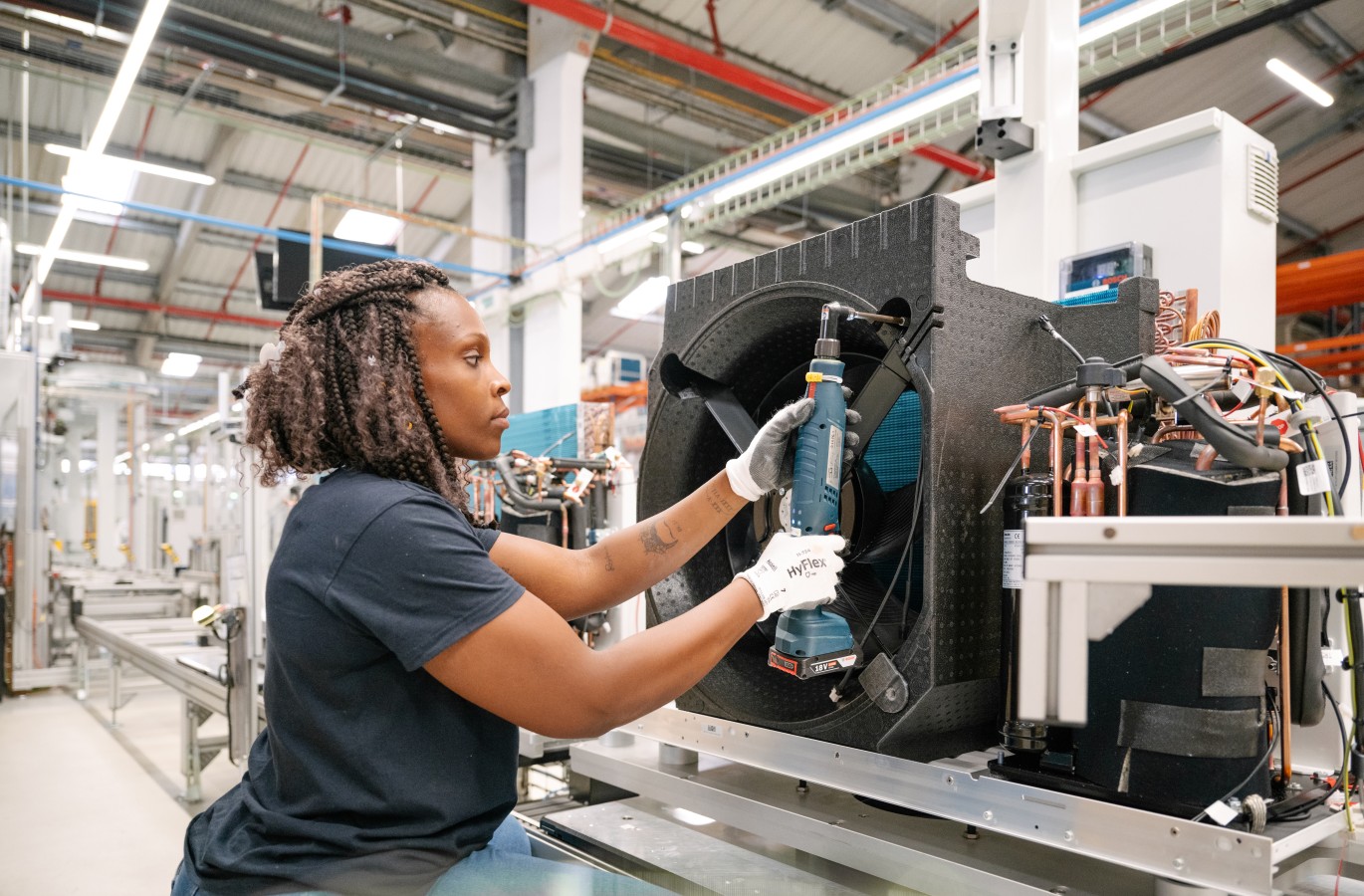

Growth area: heat pumps

Bosch is also systematically exploiting growth opportunities in heating technology. Although the European heat pump market stagnated in 2023, Bosch was able to increase its sales by almost 50 per cent. Bosch will continue to grow significantly faster than the market in this segment in the coming years. “We have not only invested in production capacity but also expanded our product portfolio, with heat pumps that are quiet, efficient ánd cost-effective,” Hartung says. The Bosch chairman sees additional sales potential in hybrid heating systems: a combination of a heat pump for basic operation and a gas boiler for peak loads. This will enable the efficient decarbonisation of millions of existing buildings. In a first phase, Bosch is introducing a solution with this technology for apartment buildings with up to 100 residential units. Hartung also refers to the controversial debate over Germany's heating law, which has hampered long-term purchasing decisions and severely weakened the heating market. “When climate and energy policies contradict each other, investors do not invest but wait and see,” he says. “Growth requires a clear and predictable subsidy policy.”

Climate policy: a carbon-neutral future requires sustainable investments

Climate action continues to play a central role for Bosch. According to Hartung, it offers great growth opportunities, even if markets such as electromobility are developing more slowly than expected. “Nevertheless, we see that climate action is no longer the only challenge at the top of the political agenda, in light of complex geopolitics and increasing social tensions in our society,” he says. Nevertheless, Bosch continues to make large initial investments in technologies for a carbon-neutral future to shape this transformation from the top down. Hartung explains, “Subsidisation of carbon-efficient technologies is under pressure. But climate action requires sustained investment by government, by companies and by each of us.”

Financial year 2023: improved free cash flow, large initial investments

While Bosch's stock levels were still heavily affected last year by uncertainties following the COVID-19 pandemic and the chip shortage, the situation is now returning to normal. As a result, free cash flow improved to 2.2 billion euros. This corresponds to 2.4 per cent of sales and is better than the minimum target of 1.0 per cent. The equity ratio was 44.2 per cent (2022: 46.6 per cent). Research and development expenditure remained stable at a high level of €7.3 billion (2022: €7.2 billion), leading to an R&D ratio of 8 per cent (2022: 8.2 per cent). Capital investment reached a new peak of 5.5 billion euros (2022: 4.9 billion euros). Forschner explains, “We are also very attentive to the cost-effectiveness of our initial investments, which exceeded 12 billion euros in 2023, and we adjust our projects if necessary.”

Financial year 2023: developments by business sector

The business sector Mobility realised revenue growth of 6.9 per cent to 56.2 billion euros. Adjusted for exchange rate effects, this growth amounted to 10.9 per cent. The EBIT margin from operating activities was 4.4 per cent (2022: 3.4 per cent). In the business sector Industrial Technology sales rose to 7.4 billion euros. This 6.8 per cent growth (10.2 per cent adjusted for exchange rate effects) was due to the first-time consolidation of the HydraForce and Elmo Motion Control acquisitions. The EBIT margin remained stable at 9.1 per cent (2022: 9.8 per cent). In the business sector Consumer Goods sales amounted to 19.9 billion euro, down 6.6 per cent from the previous year; adjusted for currency effects, this is a slight decline of 1.2 per cent. The EBIT margin from operating activities remained unchanged at 4.5 per cent. In the business sector Energy and Building Technologies sales rose 10.5 per cent to 7.7 billion euros or 13.2 per cent adjusted for exchange rate effects. EBIT margin from operating activities came to 9 per cent (2022: 6 per cent).

Financial year 2023: developments by region

At Europe sales amounted to 46.8 billion euros. That's up 5.5 per cent on last year, or 7.9 per cent adjusted for currency effects. In North America sales rose 6.2 per cent to 15.2 billion euros. Adjusted for exchange rate effects, this represents growth of 8 per cent. Sales in South America reached 1.7 billion euros, compared to 1.8 billion euros the year before. Adjusted for exchange rate effects, this 6.2 per cent decline equates to 1.8 per cent growth. In Asia-Pacific, including other regions, sales amounted to 27.9 billion euros. Adjusted for exchange rate effects, this slight growth of 0.6 per cent represents significant growth of 8.6 per cent.

Financial year 2023: workforce growth of around 2 per cent

At the end of the year, the company had 429,416 employees worldwide, 8078 more than the previous year. The number of employees increased in all regions, including Germany. The strongest regional growth was recorded in the Americas.